Podcast: Play in new window | Download

Sticky Learning Lunch 45: Increase Your Category Opportunities

Today’s topic, Increase the Number of Category Opportunities Landed Part 2.

73% of your Category Opportunities Never Make it to Store.

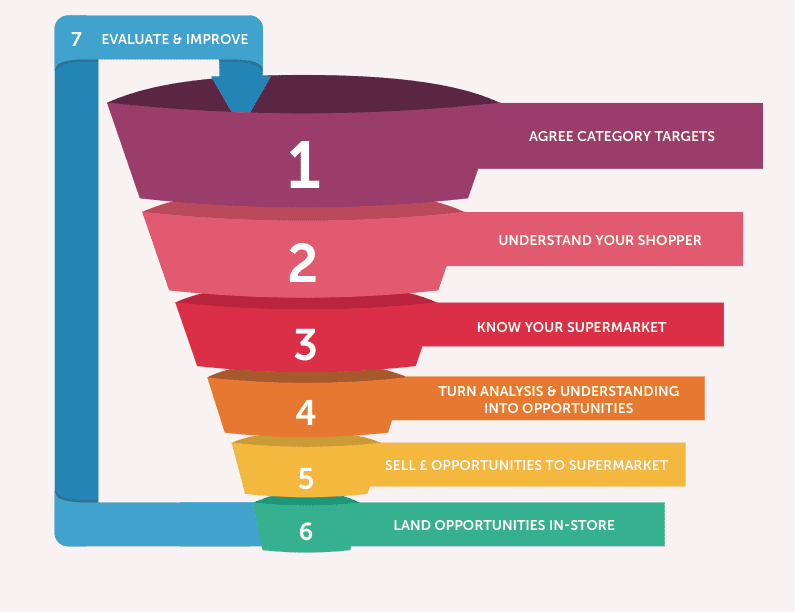

You will learn: – Each of the 7 parts of the MBM Category Management Funnel. – How each part is essential to creating an effective Category Management approach. – Various tools and techniques to support each stage of the process.

You Can Read the Full Transcript Below:

Nathan Simmonds:

Good afternoon. Welcome to Sticky Learning Lunches with me, Nathan Simmons, and also the delectable Andy Palmer delivering to this week. And for the next week, we’re just gonna give it a few minutes while the last people arrive, and then we’re gonna dive into today’s content. Just gonna give it another 30 seconds or so. While we’re doing that, let’s just make sure we’re setting ourselves up for success. And I’ll give people a reminder when we go back into this very briefly, let’s make sure we’re lighting up those phones.

Nathan Simmonds:

Get the little airplane, lift up, zero out the distraction, a hundred percent attention on what we’re doing here today. The investment in yourself and the learning that you’re about to get. Also, making sure that you’ve got a fresh sheet, fresh sheet for fresh thinking at the top of that page. You’re gonna write keepers. Those keepers are gonna be the things that you want to remember and remind yourself about so that you can reread them and reignite that thinking.

Nathan Simmonds:

So as you are looking at the category management funnel, it’s gonna help you get more clarity on what your targets are, know who your customer is, and knowing who your clients and your supermarkets are, all these key elements, by making sure you’re documenting these key points can be absolutely vital, right? Today we’re not gonna be doing too much screen sharing. So we’ve got Andy on camera one. We’ve got me on camera two.

Nathan Simmonds:

I’m gonna be here to be asking questions as we go through to making sure we get these points across. We’re gonna start with a recap from part one just to make sure we’re following that train of thought. And then what we’re gonna do is we’re gonna fly in and start looking at how to understand your shopper is absolutely vital for making this work. Andy, what have we got for day two?

Andy Palmer:

Excellent. So yeah, thank you Nathan. Today, absolutely more about understanding the shopper, keeping the shopper at the heart of all the decisions we make to help grow our category sales, our category profit, whatever measure we’ve got in place, which links us nicely. Back to what we talked about yesterday, right off the top of the funnel. Agreeing category targets the importance of having ideally a single focused point with a timeline that we want to achieve it and making sure we hit it focuses all our time and all of our efforts on getting what we want from this category.

Andy Palmer:

So yesterday we briefly talked about what f and pen, which was how much people are spending, how often they’re buying, and how many people we’ve got buying, and maybe picking one of those as an example and targeting then our efforts towards achieving that. So yes, there was about agreeing a category target.

Andy Palmer:

Once we’ve got our category target, we can then start to move down and we’ll continue to move down our funnel over the next few days. Kicking back off again on Monday. Today’s about understanding the shopper. When we get into Monday, we’re gonna be talking about understanding the supermarket or the channel that you are selling into. From there, it’s about identifying opportunities, then about selling those opportunities, adding those opportunities down at stage six, and then coming all the way back round with evaluating and improving to keep this continuous cycles mythology absolutely alive.

Andy Palmer:

As I mentioned yesterday, these stages work together. But yeah, at the same time, they’re not so much of a start, stop, start, stop. It’s very much an overlap with that recycling that’s gonna be going on. So we’ve got a category target. Today we’re gonna be talking about understanding the shopper.

Andy Palmer:

I’m sure I’m preaching to the converter on this. Keeping the shopper at the heart of our decision is absolutely paramount to everything we do within category management. There is no good us making decisions on our range, our promotional plan, the products we’ve got out there in the myriad of other levers and buttons that we can push and pull if we’re not considering who the end user is.

Andy Palmer:

And effectively that’s us. We are the people that push trolleys, carry baskets, pick things up off the shelves, and yet too often we kind of put them over here and, and leave them out of our decision making process. So it’s absolutely key that we keep ourselves and the rest of those people that are out there purchasing at the core of what we’re talking about. So a few things to share with you today.

Andy Palmer:

Let me lemme sign and place where we’re at today. So with three category targets, we’re now in stage two understanding our shopper. A couple of things to share with you on this. First one, we have been doing category management for a very long time and time to time again, we see that often only a third of this particular area is focused on. And third that we see most clients work on is the shopper, the person who’s actually buying the product. I wanna offer you an alternative that allows you then to consider some other areas.

Andy Palmer:

So I’m gonna introduce the concept of the shopper, the preparer and the eater. There’s three different groups. Again, there can sometimes be one and the same thing. If we consider the shopper preparing eater, those who are buying it, those who are preparing it, and those who are eating it, we can then start to make some seriously powerful informed decisions on the stuff that we try to do.

Andy Palmer:

So let’s not just think about the shopper, let’s also consider those other groups, bringing that to life for a moment. Then what do we mean by the shopper pernita? Pretty sticking over there. Shop perta. What do we mean by that? So shopper, it’s us. We’re out in the supermarket. My wife will send me to the shops and she’ll say, can you go and pick up some pack of fish fingers? I’m the shop, I’m buying those fish fingers. I’m looking for all the right cues in the store to entice me to pick up a certain pack.

Andy Palmer:

It’s gonna be around price, packaging, what’s in it? If it’s added Omega-3 or something like that, they’re the things that are going to entice me to make that perk decision. And then coming back fish, maybe hand ’em off to my wife. Maybe I’m gonna be the cooker, but I’m gonna be preparer for that particular meal.

Andy Palmer:

So I’m taking my fish fingers, of course I’m adding some additional elements to it. Am I then I may be not against eating fish fingers, but it could be for my daughter. She’s eight years old. She loves fish fingers, so we’re gonna cook her fish fingers, some, maybe some mashed potatoes, some other stuff that goes with it. She’s the eater. We are then three potentially very distinct groups. And on this occasion, maybe they don’t overlap one person’s shopping, one person’s cooking or preparing another person’s eating.

Andy Palmer:

And yet other times the shopper pairer and eater could be the same person. The important thing to take from that is how can we consider the decisions that we’re making to more better influence mode? More importantly, understand those three different areas. So shop, consider those and then consider what you can do differently as a result of really fully understand them. Is that making sense so far, Nathan? Let me, lemme bring you in for a second. Is that making sense to you?

Nathan Simmonds:

It makes absolute sense to me. And the, the way that it gets me thinking is often when you start a business or you’re selling a service, the idea is that you fall in love with the problem. So a lot of businesses and a lot of I guess kind of category management, people doing the same sort of thing will fail, is because they fall in love with a solution. This is a great idea, this is a great product. It looks like this, this is gonna sell millions.

Nathan Simmonds:

And then they put it out there and they’re like, no, it doesn’t because no one likes what we’re talking about. ’cause It doesn’t solve the problem for them. And the, the story that comes to mind is when they were talking about washing powders previously, and they were, they were talking, oh, well we need, we need to make these sheets whiter than white.

Nathan Simmonds:

You know, the whole ba ultra thing, you know, blah, blah, blah, blah, all these sorts of things. Wenatchee, I think in the fifties or sixties, when they did that research, it had nothing to do with whether the sheets were white. It was to do with whether or not it actually smelled good. So they were selling all this, you know, spending all this money on advertising campaigns to make these pictures of these beautiful, and actually all we needed to do was sniff it, did it smell good?

Nathan Simmonds:

So he was understanding the problem of the shopper or the needs and the problems of the shopper, the preparer and the eater. And having an idea of how to bridge all those gaps to make sure that every one of those individual groups is happy. So you sell more of that product.

Andy Palmer:

Absolutely. I talk about this in kind of the realms of what are their barriers and what are their motivations to purchase, what, what’s going to entice ’em to, to pick it up, entice ’em to use it, entice ’em to eat it, and what are the barriers preventing those things. Once we understand that, we can then make, as you said, more informed decisions. We did a project or maybe five or six years ago now, and we were talking about fresh salads and we were had room full of shoppers people who are actually buying and eating these products on a, on a weekly basis.

Andy Palmer:

We really wanted to get into the heart of, of kind of their understanding. After a series of research groups, we were able to segment these, these groups and pace out. And it was very much based on their enjoyment of salad, very normal word and how often they bought.

Andy Palmer:

So their frequency, once we’d segmented into the people that had massive high enjoyment and they were buying it, often we knew that these were our our salad addicts, the doors, the people that just love salad for many, many health reasons, flavor and all of that stuff. So we could target them as a particular group by giving them more inspirational ideas and helping them to expand the consumption they’ve got. And then we also knew that the flip side of the coin was those that were the avoiders, they did need to too much, and if they did, they were kind of having low enjoyment from it. So we knew we could entice them with a different approach.

Andy Palmer:

Maybe we were focusing our promotional strategy with focusing the the particular product mix in this bag. We were getting tons and tons of ideas back from them to allow us them to make better decisions on everything. We then did. To your point, it’s just about understanding what people actually want and need as opposed to maybe trying to second guess it, which is fine if it’s then tested, but not if it’s just pushed out, they’re expecting it to work.

Nathan Simmonds:

Not sure if you’ve frozen that there, but yeah. So the idea is, is it is all well and good to test it, but actually doing some of that kind of research and having that comprehension beforehand of kind of creating the image of a customer, creating a kind of ideal client avatar. What are their barriers? What are their challenges? And what are the potential solutions that we can offer as, as a service, as a product provider and bridging that gap for ’em.

Andy Palmer:

Absolutely. and for me, the, the kind of language that’s typically used in cash management. So there things called pen portraits, which is almost that point where you’ve said, again, who are our ideal shoppers? Who are our core shoppers? Who are the shoppers that we wanted to go after? And if we can create that pen portrait of who they actually are, we can bring them to life. Ms. Selfridges did this absolutely brilliantly. Back in the day, they would have a big cardboard cutout. It was at the front of their head office.

Andy Palmer:

So as the buyers walked in every day to do their job, there was a cardboard cutout of their ideal shopper. She was her age group, how much disposable spend she had, what her hobbies and interests were, and a whole list of additional appropriate elements that kept their core shopper at the front of their mind.

Andy Palmer:

So as they were making buying decisions product development decisions, they, they knew who their shopper was. Absolutely. It’s keeping them there. And to get to that, you know what, we can invest tens of thousands of pounds in qualitative consumer groups, focus groups to understand that, which is good. We’ve got a real solid understanding there. And at the same time, we can get out ourselves out into store and observe the things that are going on.

Andy Palmer:

We can talk to those people out there, you know, sometimes need permission to do this stuff, but to get out and say, Hey, excuse me, I’ve just noticed you picked up that pack of tomatoes. What’s behind your decision? What are you using it for? You? Okay, if I ask you these questions just to get some box pops, to get some initial insight that we can then go off and validate a more robust level.

Andy Palmer:

Once we’ve got that information, we can then start making some seriously brilliantly informed decisions. We can take those pen portraits, figure out who our shopper is. Whether that’s based on some demographic information of socioeconomic group or age group or whatever that may be, bringing it then down to understand their barriers, their motivations. We can share that stuff with the business. We can share that stuff wider. So everyone within our company, both internally and externally, is focused on ensuring that we we’re doing the right thing for our shoppers.

Andy Palmer:

Coming back to the salad example earlier, one of the biggest things that came out was people were saying, well, what makes you pick up that particular bag of salads versus that one over there? And one lady, she picked up this bag and she went, it’s bounce. And we kind of stood there looking at each other.

Andy Palmer:

She mean my bounce and all the other people in the group nodded. Yeah, it’s bounce. And what they meant was it was the freshness that it didn’t have a river of water running across the bottom of the bag. The leaves look vibrant, the leaves look kind of, it just kind of, I wanna eat that now. And they referred to that as bounce. This product had to have bounce in the bag and, and that was the term that was never heard before. What it allowed us to do was to take that very simple piece terminology, just in real world language, take it back to the business and go, you know what?

Andy Palmer:

Every product comes off our production lines. It needs to have bounce. We can tell our store colleagues, if you’re putting a product out that doesn’t have bounce, then it doesn’t go out there or it gets reduced and, and, and put off into the clear area. Take this very simple piece of understanding and just make it something so real that can then just exist right across the supply chain, right across the store formats to ensure that we’re achieving what our shoppers want in terms of their, their real world experiences.

Nathan Simmonds:

And I think it’s kind of that boots on the ground experience and going, having that face-to-face conversation is gonna play dividends. Like you say, you could be doing a focus group, but that takes time even to do the kind of a fast version. You know, creating a survey and sending it out on SurveyMonkey or doing that takes time to get that data and collate it. And then you’ve gotta see will people, will people actually ask.

Nathan Simmonds:

But actually going into a store and asking five to 10 people and giving them a free sample of a product to get that real time experience face-to-face from a, you know, from two or three people from your, that, that kind of that market and taking that information away immediately and then sticking that back into the top of the, in top of the funnel and then actually feed it back through before your product even hits the shelf. You know, it is a fast moving and b actually critical to make sure that you are in your category.

Andy Palmer:

Absolutely. Absolutely. And some of the smallest observations can lead to the most powerful insights and then the most significantly important recommendations. If I kind of cast my mind back, and I’m probably gonna go back about 15, 20 years now, we were doing a load of research again in fresh produce. ’cause A lot of that is my background. And we’re watching shoppers interact with avocados and what, what are you buying that for?

Andy Palmer:

Oh, I’m gonna be buying it ’cause I’m gonna put it with some bacon, bacon and some bread. I’m gonna make sandwich or I’m gonna be using it for this and I’m gonna be putting it in my salad. And suddenly it dawned on us that avocados weren’t being brought because they were a fruit, which is where they were living at the time, but they were being brought ’cause they were being used as part of a meal typically or more often than not was involved in a salad.

Andy Palmer:

So suddenly we kind of had this brainwave, we went, hang on a minute, we’re merchandising avocados because it’s a fruit with the other fruit, but it’s not brought as a fruit. Why don’t we pick up avocados and start merchandising them with the salads, which is where you will now find them. Thinking pretty much all retailers now, if not all of them now, ’cause that is a true shopper decision making hierarchy. People wanna go and buy avocados.

Andy Palmer:

They’re not gonna go, go and look by my other exotic fruit. I go and look by pineapples, I’m sure I’m gonna find ’em next to the coconuts. But you now expect to find your avocados in the salad fixture along with the other salad vegetables, overnight sales doubled rock and roll. Everyone’s a winner. Consumers get what they want and can find it where they expect to and you can improve sales. And just that simple observational stuff can lead to, to changes literally overnight.

Nathan Simmonds:

And the interesting thing is you say that it brings me back to my history of living in Brazil, briefly going to supermarkets there and actually in Brazil, predominantly they eat avocados as a sweet dish so they will add sugar to it. Whereas in the UK predominantly it’s done as a savory. So it’s, again, it’s a category meaning like understanding.

Nathan Simmonds:

If you were suddenly to be selling that product in Brazil because you changed the environment with depending on the company you worked in, actually going and seeing what the consumer does there, it’s actually gonna save you a lot of pain and a lot of heartache and actually understand what they do when you change geographically as well.

Andy Palmer:

Absolutely. And there are of course different nuances both within certain countries and in certain regions within certain countries. And we have our particular buying habits that we want to, are trying to align to. Again, I’m gonna, another very brief story. 25 years ago, and I was probably about 12 months old at the time, okay, 25 years ago. 25 years ago, I was an in-store merchandising manager.

Andy Palmer:

I was responsible for the layouts of the stores. And so as grams would come down from head office, my team and I would go and relay and move things around. This was back at kind of the advent of as category management was really starting to accelerate and week after week I’d get these big range of view packs, land on my desk and I’d say to the team, right, we need to go and move X, y, and Z and stuff.

Andy Palmer:

One day this pack arrived on the, on my desk and it said in short and sort of simple terms, go and pick up the four foot canned tomato by bay and I want you to move it two aisles over and drop it in in our floor next door, the dry pasta. And we were kind of scratching our heads thinking what’s all this about? But okay, what we’ll do it, ours is not to reason why. So we picked up all the canned tomatoes, moved it a couple of hours down the store, relayed all the other fixtures to make space and close the space up.

Andy Palmer:

And I thinking, right, okay, can tomatoes, right? Pasta got it. Jobs good. Tick that one on onto the next one. Over the coming days and weeks, the amount of customer complaints. Where, where’s the can tomatoes gone? I can’t find the chopped tomatoes, I can’t find my peeled tomatoes.

Andy Palmer:

You what’s going on? Okay, no problems. We’re hearing you, we’ll put some signs up, canned tomatoes and now in aisle five, well why have you moved this? And we’re kind of going, we dunno. So we thought we’d phone up, we phoned up head office and said, Hey look, we’re getting a lot of customer feedback on this. We we wanna be able to, to kind of answer some questions and find out what’s going on.

Andy Palmer:

And he said, oh, we’ve done one of these massive category management reviews and we found out that there’s a really high propensity of people who are buying dried pasta, also buy canned tomatoes because they’re making their own fresh pasta sauce. Brilliant. Makes sense. We’ve now got a reason why that’s happening. The problem was and it can often be the case with category management, is that that particular piece of work was done from a pasta perspective.

Andy Palmer:

So the pasta guys had gone off and done all this research and figured out the the correlation between dried pasta and tin tomatoes and they putting these things together would make the shoppers life so much easier. But because they only came in from the pasta perspective, they’d failed to take into account the other tomato perspective. But tomatoes, especially tin tomatoes, can be used in a number of dishes, right from your kind of breakfast all the way through the day, right down to many our kind of other evening meals. So for me that was a great example of trying to do the right thing for a category, but not being mindful and powerful enough to consider the broader, wider perspective.

Andy Palmer:

So if we’re doing our category management, yes we can make decisions that on face value and according to the data, which really powerful yet at the same time can be horribly detrimental to, to the shopper’s experience and just some of that common sense that canned goods you’d expect to find canned tomatoes. And so it plays out. We’ve just gotta be very, very mindful that we’re seeing a, a much more broader perspective when we’re making our recommendations.

Nathan Simmonds:

And in my head, as you were saying it is coming is rather than making that swing decision and causing that kind of unrest in the shopper environment because we know confused people don’t buy. And if there’s that level of kind of that, that, that primordial thinking, the amygdala’s kicking in and panic, well I don’t know what this is actually, they’ll buy less when they go into store until that stuff neutralizes and balances out. It’s about making a kind of a transition.

Nathan Simmonds:

And in my head it’s almost thinking Marmite on crackers or pickle on pickle with cold meats. You know, you wouldn’t necessarily put, you know, the, a jar of Marmite in the biscuit aisle or you wouldn’t necessarily put the pickle in the cold meat section, but what you might do is create a product or something that allows you tundra to almost bleed into that area. So you would have marmite flavored crackers and you would have pickle import pies.

Andy Palmer:

And, and that’s where a lot of products innovation comes from. And we’ve seen this proliferation of new products and existing product developments start to kick in where we’re trying to satisfy many, many needs. The patha category again is actually a really good example of this, where there are literally dozens and dozens and dozens of different types of pasta. Everything from our, our swells, our tubes, our ribbons, our bows our colors, whether it’s what, just a, a multitude of things, but if you’re gonna speak to any true Italian and of which we’ve done this with a number of pieces of research, they would just literally laugh and go, that’s, that’s not how it should be.

Andy Palmer:

But it’s what this market allowed us to evolve in almost over complicated times. So we’ve just gotta add to your point, add that kind of modicum of common sense and try to hone our decisions down to finding out what customers really want as opposed to trying to second guess what they actually want. That’s, that becomes super powerful.

Nathan Simmonds:

Awesome. I’m just conscious the time rocket is already 22 minutes past one. Just in conclusion, what are the key elements that you need to be including or people need to be including when we are looking at understanding the shopper then

Andy Palmer:

I think a great place to start is, is this stuff here that there are not just one type of shopper and we can get into the semantics of shopper, consumer user. I think for, for the challenge will always be you’ve got to find appropriate wording for your business. Consumer seems to be the one that’s historically being used but doesn’t fit many categories. You know, consumer doesn’t fit the the washing des surgeon category very much. We don’t consume per say, a washing powder.

Andy Palmer:

We could use words like chooser and user but actually just keeping it very simple, who the shopper, the pair of needs become super powerful then understanding what they actually want, what they need and getting into the crux of real world is, is super powerful. Terry Lehe, when he was the marketing director for Tescos before he was running the show was interviewed once and someone said to him you, you seem to always win all of the arguments and all of the debates and all the discussions in the boardroom, why is that?

Andy Palmer:

And he says, well, I’m the marketing director, I have the voice of the shopper that’s not open for challenge. What he’s basically saying is that every rationale thought that he had was backed up by consumer understanding. Consumer needs, shopper needs. And in which case that’s not open for challenge ’cause that’s what’s actually needed.

Nathan Simmonds:

Super simple, super simple, get the voice of the customer and make it happen much amazing. Very much so. Open floor. I know we flew straight into information, you know, what has been useful from today’s conversation. Let’s last out the question box and let see, you know, what people are taking away from this and also what questions are coming through. Hyperconscious hyper respect of the fact that it’s 24 minutes past one already. What has been useful from understanding what your consumer is looking for? What’s been valuable from this session and where else can we we cast any more light on this?

Nathan Simmonds:

Let’s just give that a moment for responses to come through. I think it’s interesting when you’re looking for me is looking at when we are seeing those that that can tomato situation and actually that limited kind of perspective of making sure we’re broadening that out and that realization actually when you’re standing in a supermarket and looking around, oh this is why certain brands are doing certain things at certain times because they’re using that client that that that client customer de analytics.

Andy Palmer:

Absolutely. And there’s some good examples of where that’s been done brilliantly and some not so good examples. And you could take something like the celebration cake category now where we go and buy our Caterpillar birthday cakes. Ideal place for that to be merchandise probably next to the birthday card fixture where you find all your greeting cards and what have you, but yet we know where we’re gonna find it. It’s sorting near bread, it’s sorting near the other box cakes.

Andy Palmer:

So we kind of just typically have kept it there even though there’s a good argument to say it should go elsewhere. I think sometimes just doing that consumer research and saying to people, where do you expect to find it? Where would you want to find it? And then getting that robust sample of information to then inform your decisions. Do we leave it where it is? Should we try changing it? See if we can drive more sales. It’s funny what our shoppers want.

Nathan Simmonds:

Yeah, absolutely. I’m gonna come to a prime example about that in a second. So we’ve got one here is high value stuff’s coming in, highlighting the importance of always listening to the voice of the customer. Absolutely. and now we talked about this in PDPs and even from an organizational point of view is understanding actually what’s the, if you work in an organization, you know, potentially your customer is the people you work for, therefore you know they’re paying for a service which is you, which is, you know, listen to the voice of the customer.

Nathan Simmonds:

If you are finding there’s friction inside your job or wherever you’re working, you need to go back and kind of do that analytics of your team that you lead the department that you lead and, and, and find out what’s going on for them. Which is why we do these internal surveys and 360 feedbacks. So it’s, it’s, it’s almost this from the other side of the table. What else we’ve got, we’ve got Colin coming in is, you know, the trunk branch leaf aspect of understanding the shopper and how all are key. Absolutely. Now it, this is a systemic approach I think is the right phrase for this. You know, it’s, it is a whole system, a whole environment kind of approach to understanding what it is we need to be doing.

Nathan Simmonds:

The thank you for sharing and that, that example that came to mind was we gluten-free. So if you go to the free from section, you know, you get a certain number of pastas. But the pasta that we prefer to eat, which is gluten-free, is actually in the pasta is pasta section. So it’s not in the gluten-free section. It’s in the pasta section. So I go to the gluten-free section, the free front aisle and the passer that I want, which is free from isn’t in there and it is just like, hold on a minute, let’s just do one or the other.

Nathan Simmonds:

So I think we’re kind of getting to a point in, in the shopping environment actually the free from section is almost gonna become null and void because those products will just become part of the, I think there’s moment this gonna do this, this blurred line between what is free from and what else am I eating, et cetera.

Andy Palmer:

Absolutely. I think just with clear clear sign posting on the packet, we can allow the shopper experience to be so much simpler and go, this one’s gluten free. We don’t have to put it in a tiny little dot up in the right hand corner or merchandise it somewhere tucked around in a dark dusty corner. We had exactly a thing with organics where we would have an organic section for all the fruits and veg and then we’d say, well actually why don’t we put the organic potatoes with normal potatoes and the organic bananas with normal bananas and just ’cause people just need to have a little bit of simplicity and common sense applied to our, our our thought process.

Andy Palmer:

But it’s gotta be based on the needs of the shopper. So we’ve gotta ask them, we’ve gotta speak to ’em, we’ve gotta observe them. It’s exactly the same with so many areas across the store right now where we have over complicated it. And we’ve actually made the shopping the shopping journey more frustrating at times and not easier, which is what it should be.

Nathan Simmonds:

And in lieu when light was saying that, you know, it is, it’s in checking in with the customers intervals and then going back to that top of the, to the funnel. No, you, no, you understand your shopper. Okay, we’ve done that, everything’s great. Well six months, 12 months, 24 months later actually, is it the same experience or have things evolved and moved on?

Andy Palmer:

And they absolutely will and they typically evolve and most things tend to come full circle. So what was right 10 years ago, that’s clearly not right now. Maybe won’t be right in five years time. We, we just gotta be constantly checking and keeping our finger on the pulse of what, what’s going on out there, what our shoppers, our preparers and our eaters really need at the end of the day, that’s us. We can’t base our decisions on our personal preferences, but we can get a strong robust sample of people to, to be able to make informed decisions and understand the impacts of those decisions.

Nathan Simmonds:

Mm-Hmm, and Colin’s hit the nail on the head. You know, the shoppers aren’t stupid, we need to make it easier for them. Yeah, apart

Andy Palmer:

From stupid. Yeah,

Nathan Simmonds:

Yeah. Good. Thanks Colin. Colin saying excellent day guys. Thank you. Thank you very much. Look, I’m conscious of time, it’s 29 minutes past Andy, thanks very much for sharing. What are we covering tomorrow before we close off this conversation?

Andy Palmer:

So I don’t think we are covering anything tomorrow because I think our next one’s Monday, but

Nathan Simmonds:

Ah, Monday. Yeah, sorry, Monday is indeed. Thank you Andy.

Andy Palmer:

I’m sure we’re, yeah. So Monday we’re gonna kick off with our next level of the funnel. So moving down into part three, which is understanding our supermarket, understanding our channel, that’s gonna help us to align those thoughts, those recommendations, those observations we’ve got to the needs and requirements of that particular outlet. ’cause They often, often vary. We’ve got a couple of ways we can do that.

Andy Palmer:

So that’ll be Monday, Tuesday we’re gonna get into for me the sexy stuff, which is about identifying opportunities and then turning those into recommendations based off our insights following days and landing those opportunities, sorry, selling those opportunities, then landing those opportunities and then coming all the way back round and doing our wins and repeats.

Nathan Simmonds:

Amazing. So in the chat box right now is the link for Monday’s session and the future sticky learnings. Thanks for reminding me is Friday tomorrow. Click on there if you haven’t already clicked on that link, now is the time to click on there and register for the next session. Also in that chat box we’re gonna include the category management coaching cards as well, which will walk you through the six stages of this funnel and, or sorry, the seven stages of this funnel when we loop back round. You’ve got the category management cards there.

Nathan Simmonds:

That’s five pound huge value for them just to get your category management, mindset team and your sales team interacting in a way that is gonna be helping you to look for more opportunities to grow your business. Andy, huge thanks for today, looking forward to Monday. Thanks very much everyone for being here. Really appreciated.

Take a Look at Our Podcasts.